The Federal Reserve announced another three-quarter-point hike on July 27. It was intended to cool the economy, which amongst others, a red-hot housing market characterized by escalating home prices and low inventory.

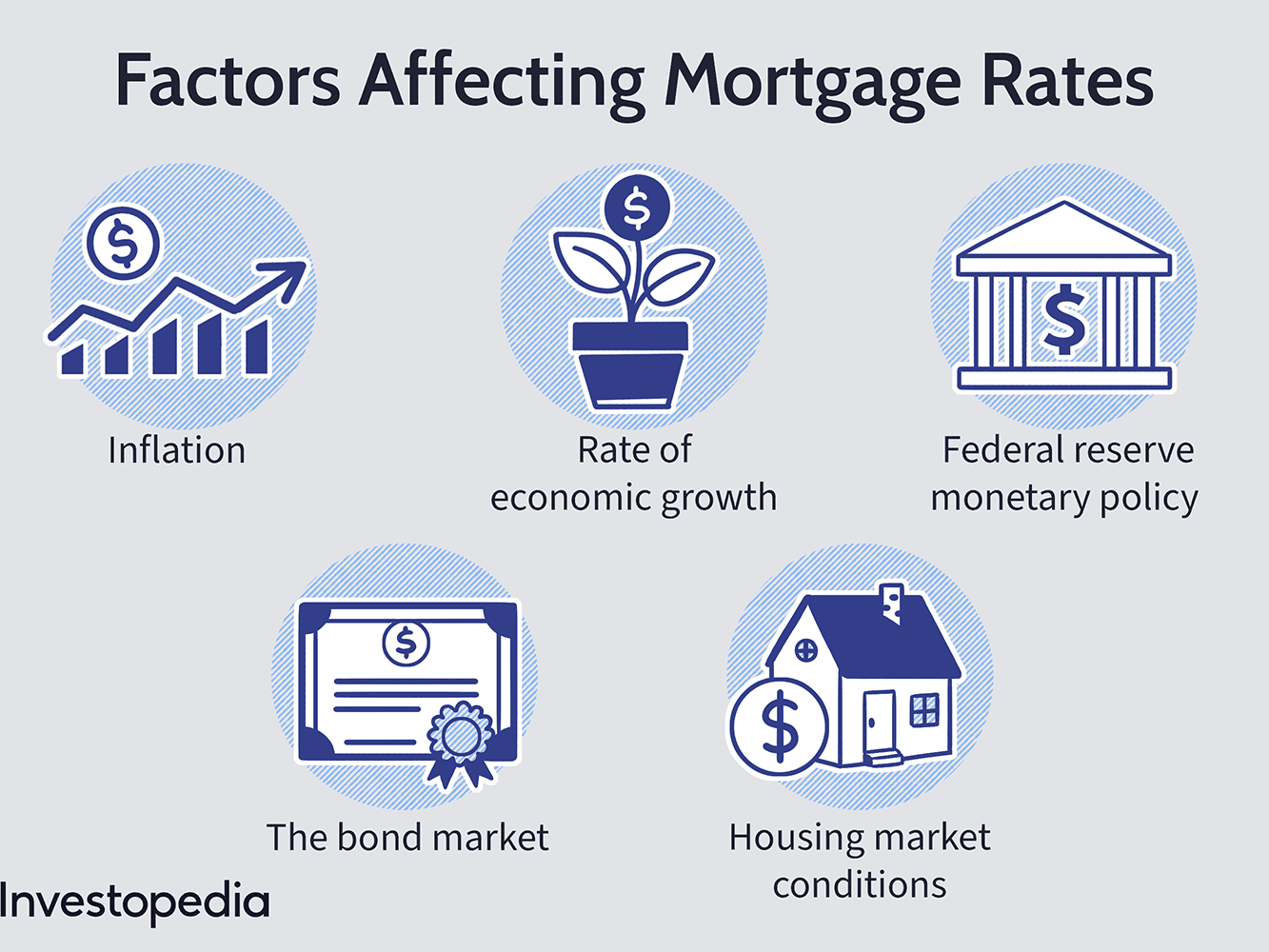

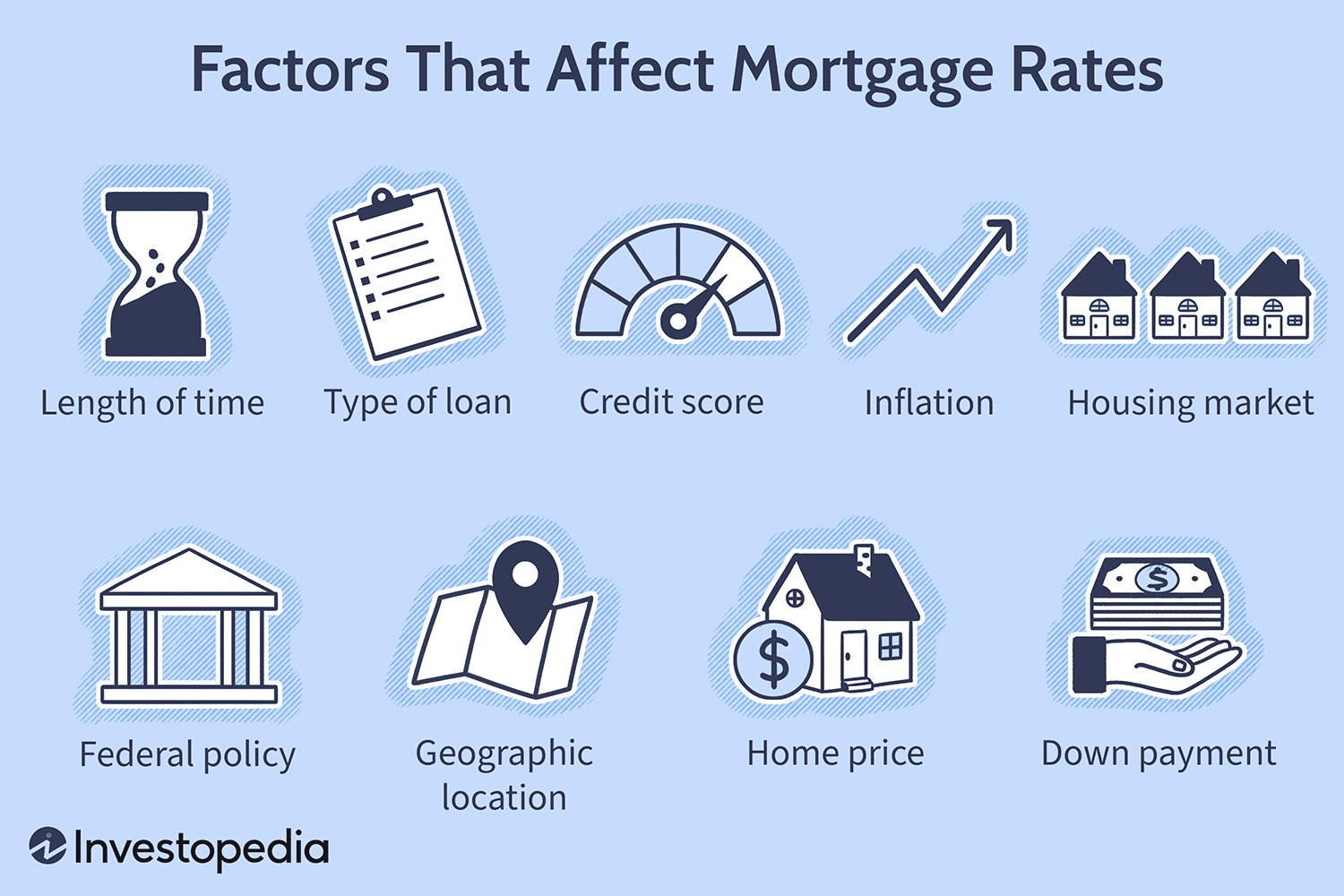

Note that the Fed does not set mortgage rates. Fed rate is a short term rate that has more direct affect on products like savings account and CDs. Mortgage rates on the other hand move in lockstep with 10-year Treasury yields. As you can see from the photos, mortgage rates are determined by many factors. The central bank’s decision set the overall tone for mortgage rates only.

In the short run, when the mortgage rates are higher, Buyers will have to cope with a higher monthly mortgage payment and Sellers can experience less offers for their homes. Overall, we expect home prices to appreciate, but at a normal pace:

Sam Khater, chief economist at mortgage giant Freddie Mac: “While home purchase demand has moderated, it remains competitive due to low existing inventory”

Lawrence Yun, NAR’s chief economist: “I expect the pace of price appreciation to slow as demand cools and as supply improves somewhat due to more home construction,”

If you are considering selling or buying, partner with a reputable, experienced local agent to guide you through the process. In Palos Verdes and South Bay, contact Stephen Haw at (310) 503-9886 to get the most out of your transaction. DRE#00808646. Keller Williams Palos Verdes Realty

Call 310.503.9886 or email skh8828(at)gmail(dotted)com for professional guidance from The Stephen Haw Group, your local experts with international connections.