Interest Rate and Buying Power

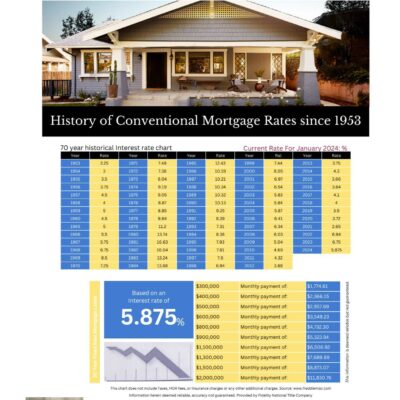

The significant decline in average 30-year mortgage rates marks a pivotal shift in buyer sentiment.

Consequently, this reduction in rates has tangibly trimmed hundreds of dollars off typical mortgage payments. Therefore, it has opened doors for many previously unable to qualify for financing.

Additionally, it presents newfound opportunities to step into the housing market. Notably, for every 1% decrease in interest rates, approximately 5 million more individuals become eligible for homeownership.

As a result, this amplifies the pool of potential buyers and stimulates demand in the real estate market. With demand surging, there’s anticipation surrounding its effect on property values.

Increased competition could lead to bidding wars and upward pressure on prices. However, it’s essential to approach these market dynamics with a strategic mindset.

Sellers may benefit from favorable conditions, but buyers should act swiftly. This is to capitalize on the current landscape before rates potentially rise again. Therefore, don’t hesitate to take advantage of these favorable conditions. Reach out to your local real estate expert. Discuss how you can leverage the current market trends.

Especially, in Palos Verdes and South Bay, connect with Stephen Haw. Get personalized guidance and expert insights tailored to your needs. With interest rates playing a significant role in shaping buying power, now is the time to explore your options.

Make informed decisions that align with your long-term financial objectives. Seize the opportunity to secure your dream home. Navigate the real estate market with confidence.

Stephen Haw

310.503.9886

Call 310.503.9886 for professional guidance from The Stephen Haw Group, your local experts with international connections.